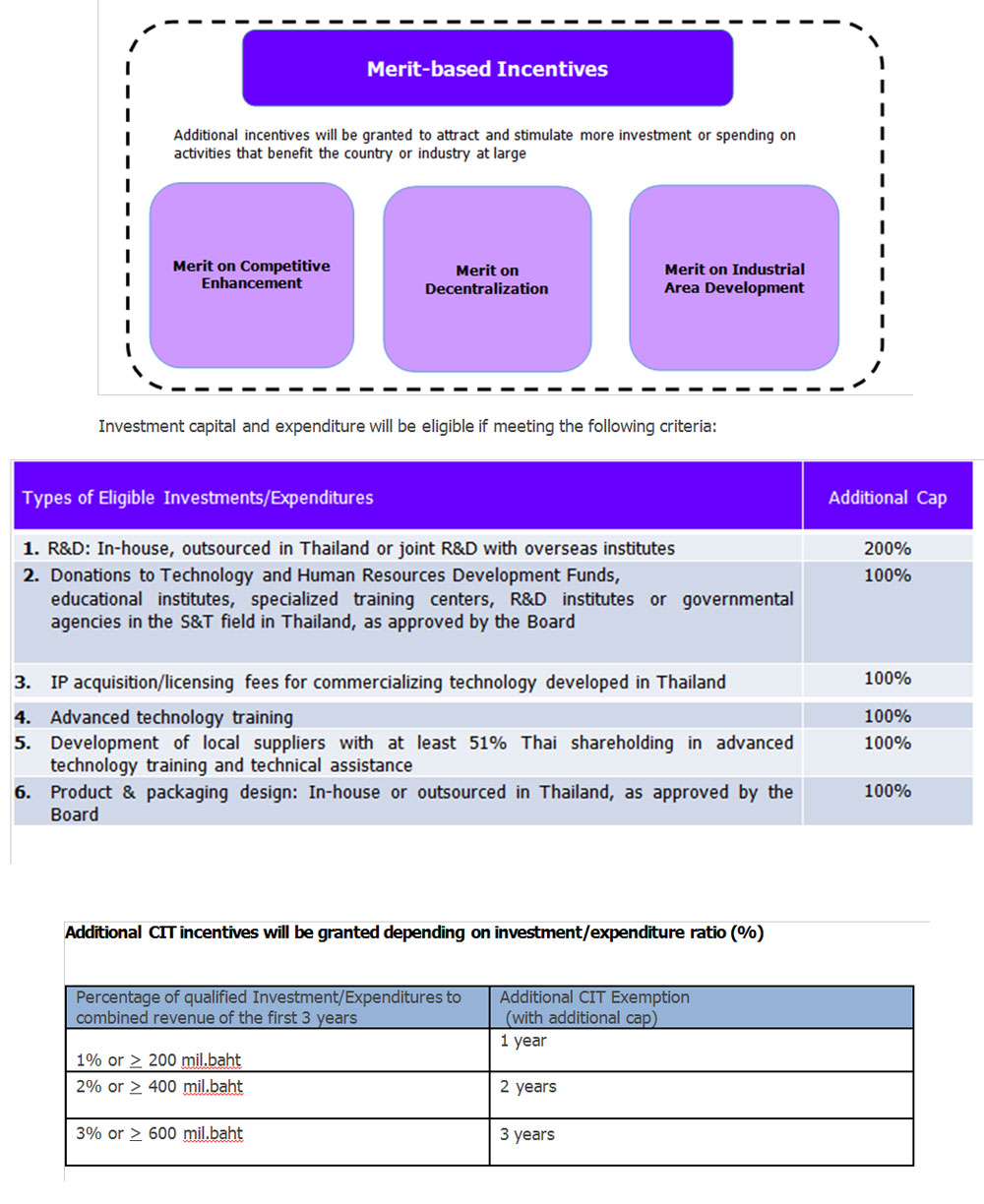

Merit - based

*

*

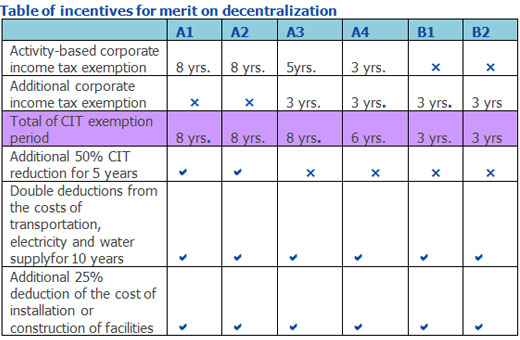

Projects located in 20 provinces with lowest per capita income—Kalasin, Chaiyaphum, Nakhon Phanom, Nan, Bueng Kan, Buri Ram, Phrae, Maha Sarakham, Mukdahan, Mae Hong Son, Yasothon, Roi Et, Si Sa Ket, Sakhon Nakhon, Sa Kaew, Sukhothai, Surin, Nong Bua Lamphu, Ubon Ratchatani and Amnatcharoen(excluding border provinces in Southern Thailand and Special Economic Development Zones which have separate special incentive packages)—shall receive additional incentives, as follows:

Three additional years of corporate income tax exemption shall be granted. Projects with activities in Group A1 or A2 which are already granted an 8-year corporate income tax exemption shall instead receive a 50% reduction of corporate income tax on net profit derived from promoted activity for 5 years after the corporate income tax exemption period expires.

*

*

Projects located within industrial estates or promoted industrial zones shall be granted one additional year of corporate income tax exemption.

*

*

1. Must submit application prior to the expiry date of the CIT exemption; before applying, CIT exemption must be inspected to ensure its continuity. If the application for merit-based incentives is approved, it will be retroactive to the date of its submission. If the investment and expenditure, for which the merit based incentive is being applied, has already been made it will then be counted as an additional right and privilege.

2. Applicants can choose to apply for one type or many types of merit-based incentives, but they must be in accordance with the prescribed criteria. Total CIT exemption cannot exceed 8 years as prescribed in section 31 under the Investment Promotion Act and no request to amend the 8 year exemption can be made under any circumstance.

3. Projects not entitled to CIT Exemption (B1 and B2) must submit the request for merit-based incentives together with the application for investment promotion.

Source: A Guide to the Board of Investment, 2015

Last Updated: July 2015